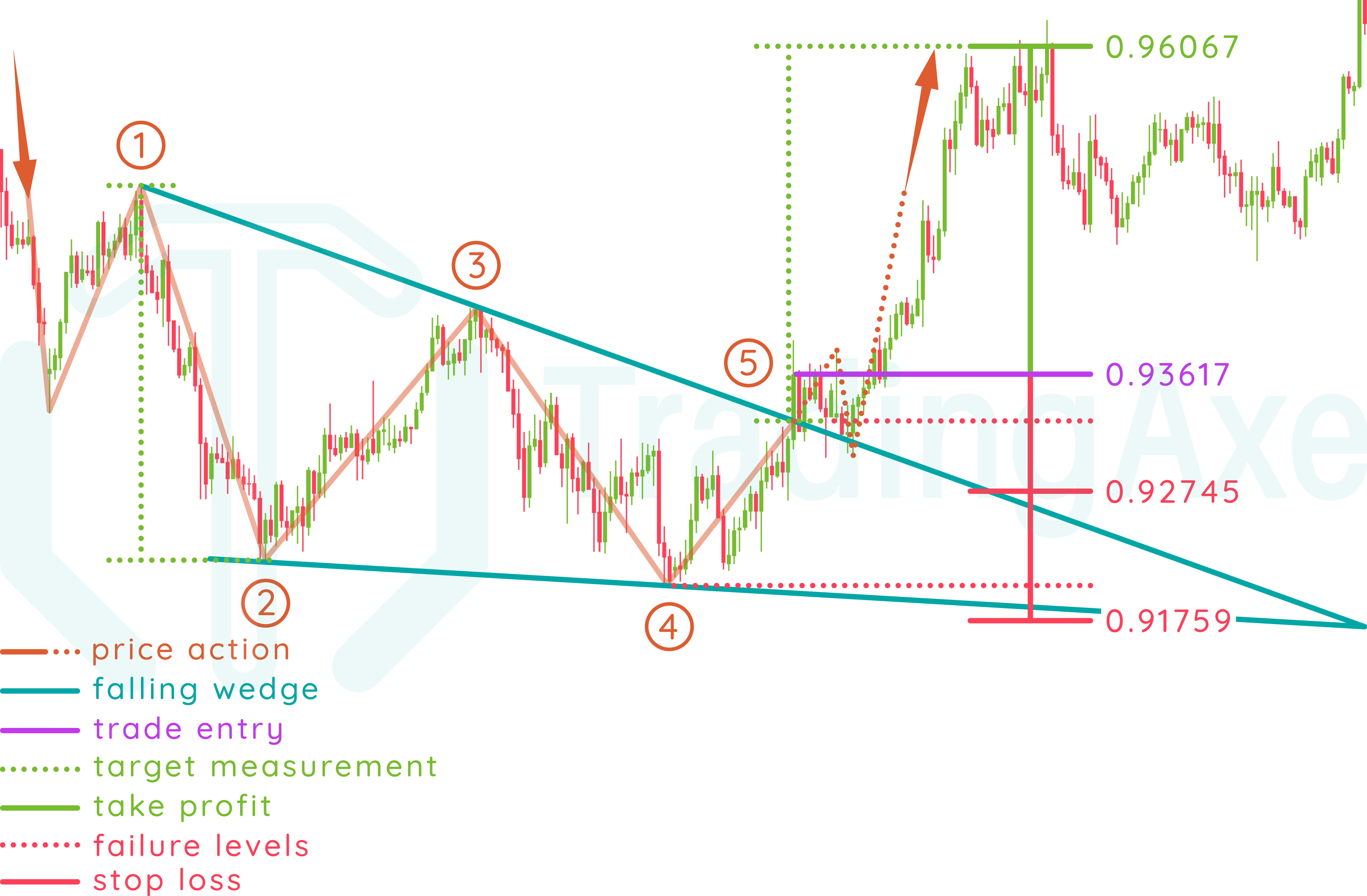

The pattern is formed by drawing the trend lines from above the highs and below the lows on the price chart. The prices of a security falling over time forms a wedge pattern as the trend makes its final downward move. This results in the price breakout from the upper trend line. Buyers join the market before the convergence of the lines resulting in low momentum in declining prices. A rising wedge pattern is considered a bearish pattern in terms of technical analysis. The bullish bias is realized as soon as a resistance breakout occurs.Ī rising wedge pattern is the opposite of a falling wedge pattern that is formed by two converging trend lines when the security prices have been rising for a long time. It starts wide at the top and converges as the price moves lower, forming a cone as the lower highs and lower lows converge. Technically, a falling wedge pattern is formed when two converging trend lines of a consistently falling stock are joined. Irrespective of the indicator of reversal or continuation, the falling wedge pattern is considered a bullish pattern. In line with that, the falling wedge pattern indicates whether the prices will keep falling or it will reverse the course of their downward momentum, depending on its location. Wedge patterns in a technical analysis indicate a trend reversal as well as continuity.

Wedges created after a downtrend is known as the falling wedge pattern. Falling Wedge PatternĪ chart pattern formed by converging two trend lines is called a wedge pattern. In this article, you will know about a bullish chart pattern called the falling wedge pattern in detail. Investor behaviours tend to repeat and hence recognizable and predictable price patterns are formed in a chart.

While technical analysis is beyond charting, it always considers price trends. Certain patterns formed in the past are most likely to result in similar results time and again. These parameters form the technical charts and analysts believe that history tends to repeat itself. Technical analysis is a method to forecast the price directions by primarily studying historical prices and volumes. Technical analysis is the key used by intraday traders and most short-term traders to analyze price movements. Introduction on Falling Wedge Bullish Reversal Patternĭay-traders wouldn’t exist if it wasn’t for charts, graphs, and patterns. What is Dematerialization & It's Process.Difference Between Demat and Trading Account.Documents Required to Open a Demat Account.Aims, Objectives and Importance of Demat Account.What is the Sub-broker Program of IIFL?.

0 kommentar(er)

0 kommentar(er)